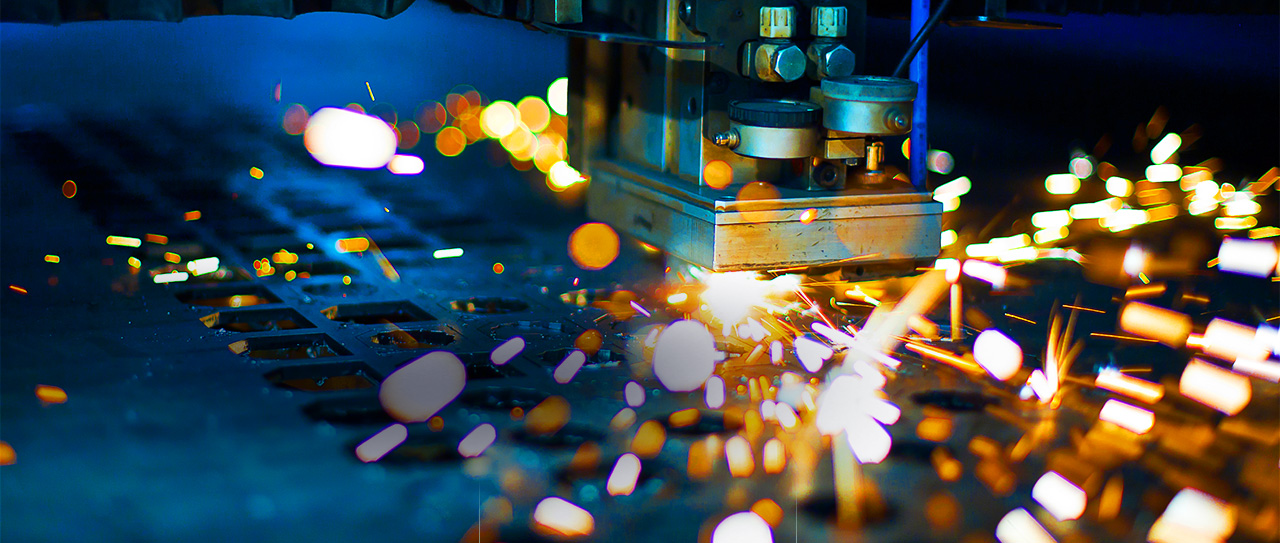

“We’re going to build our steel and aluminum industry back,” Trump said.

Demonstrating what he said, United States President Donald Trump recently stated that he would impose massive tariffs on imported steel and aluminum, while Canada and Mexico, being the primary trading partner of US, will be devoid of new tariff rules on national security ground.

An investigation by the Secretary of Commerce suggested that steel imports threaten to hinder the national security and hence recommended to impose tariffs.

Stocks of domestic steel and aluminum producers in the US brushed up immediately after the news. Tariffs may profit US steel and aluminum makers, yet other nation might strike back in response and possibly raise the expenses for American shoppers. While the Pentagon stated that the US only imports about 3% of total steel it uses and hence it is likely to have no risks involved.

Some metal fabricators may have given thumbs up to the judgment, but some economists believe that tariffs would be a big blow to the employment. Majority of Fabricating related associations have opposed the idea of the tariff. According to them, steel may or may not have been purchased domestically, but tariffs would affect the supply chain because everything revolves around the cost of a product.

According to Mark Perry, Professor at the University of Michigan, domestic steel manufacturers are at bay in comparison to the Asian manufacturers. Increased Input prices and low profit, sales and market shares will be a blow for American manufacturers.

Fabricators & Manufacturers Association, International (FMA) President and CEO Ed Youdell said, “One likely result of this action is to add headwinds to the market for American-made fabricated metal product producers. Just when this market had some sustained momentum, the specter of retaliatory duties and tariffs now hangs over this important manufacturing sector. The association is concerned that jobs and job creation are at risk; those countries affected by this announcement will likely choose to circumvent the tariffs by producing and exporting low-cost fabricated metal parts rather than exporting steel and aluminum.”

The tariffs could altogether have different monetary and political outcomes, depending on countries affected. The news walloped Asian nations like South Korea, one of the highest suppliers of steel, on the other hand, metal fabrication in Singapore and that of Malaysia’s shares rose after the tariff exemption. China, though most top exporter of steel in the world, sums to only 2.9% of steel imports in the US. To curb this loss, China can build new export markets in Asia. A source at a global trading house in Shanghai said: “We believe the fabricators can divert their exports to other Asian countries if the US situation plays out as they expect,”. A metal fabrication company in Singapore, an Aluminum trader, stated that it would be tough for China to export metal fabricated products to some Asian countries due to their import duties.

Metals are produced in excess in Asia, and hence the prices may drop due to the tariffs fiscal, which is ultimately an advantage for the customers. With the change in rate, China will have competitors like Ukraine, Russia, Turkey, Middle East etc. although the strong domestic requirement of steel will be a sign of relief for Chinese manufacturers.

Tariff on metal fabricated products might be a complicated issue, especially after 2008 financial crisis. It is worth noting how other countries and their fabricators react to it take steps to curb their export cut.