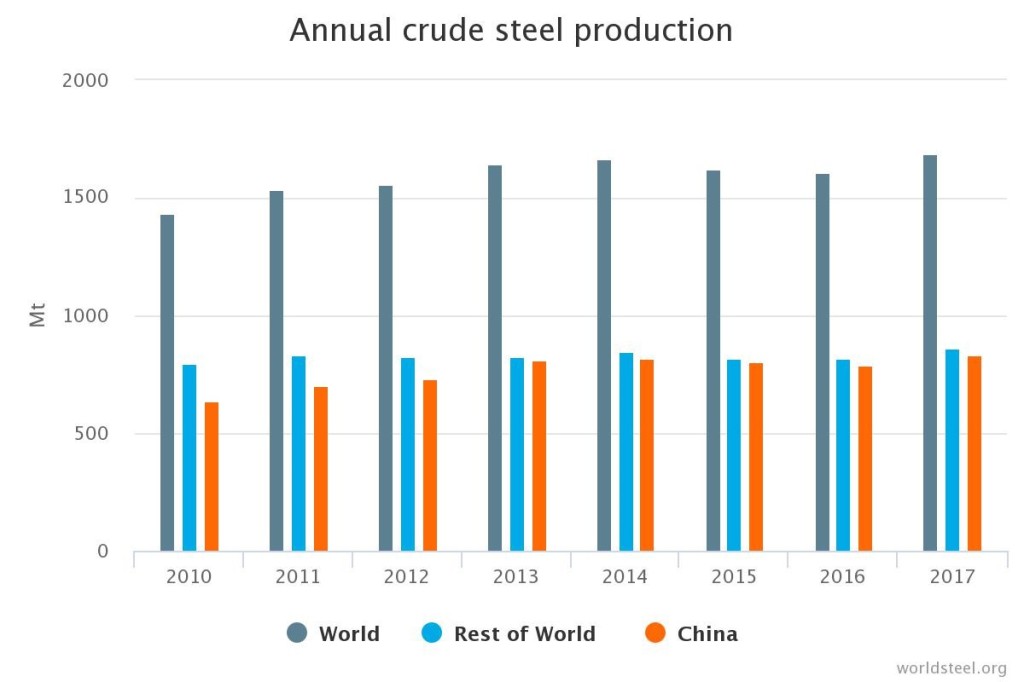

The global steel production for metal fabrication has made their journey into the sky for ten years straight from 2005 to 2015. But in 2016, the trend seems to get a pause. After 2015’s marginal growth, output dropped 3% that is 164 million tons globally in the year 2016, as mentioned in the annual report by German Steel Tube Association. But thankfully, last year’s production brought a new hope for the industry. According to WorldSteel.org, last year’s crude steel production was highest among previous years’ worldwide steel production. Previously, the record production of crude steel was in 2014 where China alone produced 822.3 million tons and the rest of the world produced 847.1 million tons, making the total production of steel around 1670 million tons. But in 2017, the production leaped a slight from 2014s 1670 million tons to 1691 million tons, where China alone produced 831.7 million tons and 859.5 million tons from rest of the world.

Source: WorldSteel.org

This rise of demand was caused by continuous use of Steel in stainless steel fabrication and steel fabrication. These steel is used for metal bending, laser cutting, manufacturing metal cabinets, boxes, metal rolling, etc. With the massive use steel, aluminium use for aluminium fabrication is also increasing rapidly. But that’s not what I’m going to cover today.

Anyway, when people asked about 2015’s drop in steel production, many came to the conclusion that it was caused by an attempt of replacing steel with other metal throughout different industries. Although the motive was to find out another metal that is more efficient and cheap in price, clearly the motive wasn’t fulfilled and we could say that from 2017’s rise in demand for steel in the global market.

This demand was scattered throughout all over the world, in different industries. As usual, the Building and Infrastructure industry had the most demand for steel. They consumed almost 50 percent of total production worldwide. Second in place for steel craving was Mechanical Equipment industry that consumed total 16 percent of annual steel production. Here the difference between Building and Infrastructure to Mechanical Equipment demand was huge. But with 13 percent consumption and demand for steel last year, Automotive industry is close to the Mechanical Equipment industry, in terms of using the steel.

On the fourth position, Metal Products kept their feet grounded like every year, using almost 11 percent of total steel production last year. From here on, other industries divide the demand between themselves according to their need. Most notably, other transportation systems is consuming 5%, Electrical Equipment 3%, and Domestic appliances 2% in total.

An Assumption

According to the claims of German Steel Tube Association, Steel pipe industry and its application have improved since the year 2016. The estimate indicated that the overall investment in energy sectors will surely get back to normal from its state after 2015’s sudden fall.

Additionally, the resulting backlog, the circular upswing in the raw metal material and steel rates should benefit the industry like the continued robust economic activity is benefitting the industrialized world. Apart from that, the German Steel Tube Association is expecting North America’s expansive economic policies and the energy policy to put a strong focus on the fossil fuels. This will have a positive effect on the steel tube and pipe industry.