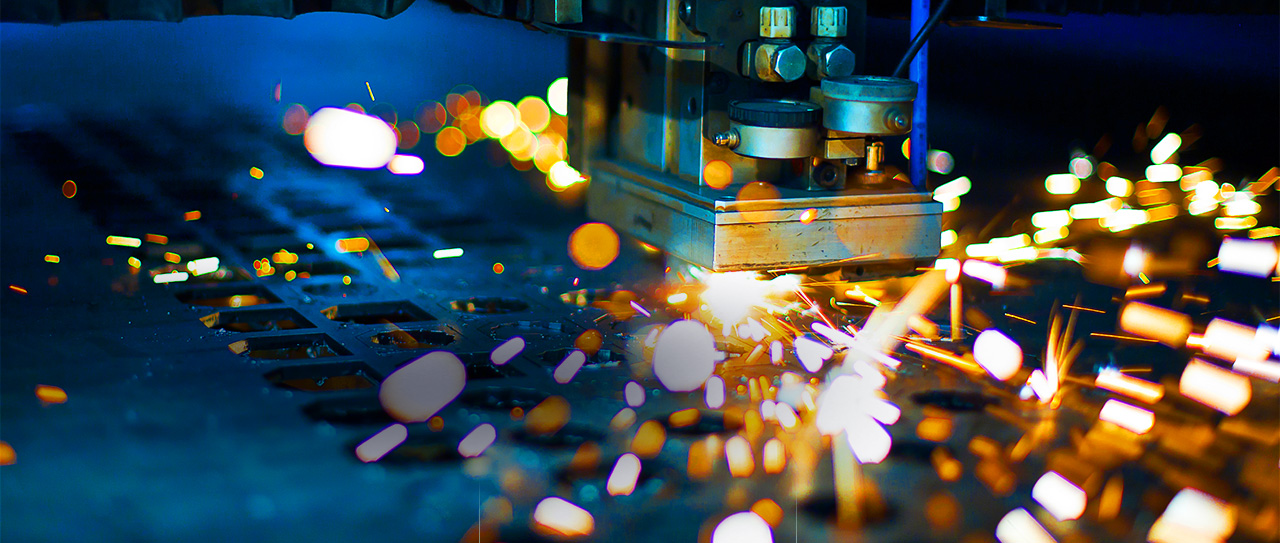

Productivity of a machine’s successor in Metal fabrication can leave the predecessor good for nothing. For example, a fiber laser cutting machine can manufacture as much as multiple Carbon Di-Oxide lasers. Again, a press braking machine, which is equipped with automatic tool changing feature can meet the production of 2-3 and more traditional mechanical or hydraulic press brake machines.

Metal fabrication industry is rapidly changing with the widened manufacturing landscape. Technology and its effect is spreading so quickly that manufacturers feel they can’t keep a machine until its end-of-life.

P. J. McElroy, the sales account manager at Siemens Financial Services said that companies nowadays can’t know for sure that what the machinery will look like, in next 5-10 years. As rapidly the tech industry is advancing, fabricators are finding it hard to keep up with.

During a panel for custom fabricator management at last year’s San Diego FABRICATOR Leadership summit, some participants pointed out to equipment financing alternatives, such as leasing, which will help them stay technically competitive.

But leasing has never been a buzzword in the Metal fabrication industry. Less than 11% of the responders to “2018 capital Spending Forecast” stated that they would like to get new equipment and tools through leasing.

However, leasing can really be flexible for companies and small business owners, according to McElroy. He explained that leasing agreement can incorporate machine upgrade option, either stuffed into the agreement or as a part of an upgrade and re-financing arrangement at the very end of the exact lease term.

But like leasing anything, leasing a machine, for example, a high-end laser cutting machine, metal rolling or metal bending press brake, etc. for Stainless Steel fabrication, Aluminium fabrication or Steel fabrication comes with some conditions.

However, leasing is not as fruitful as for the lucky one. One of the main concern for metal fabricators about leasing a machine is they fear that it won’t work as efficiently as promised.

But what makes leasing attractive?

It has something to do with freeing cash flow, which can be used on other resources, software including. Software orchestrates system within the specific machine and also coordinates the information between multiple systems within a plant or more.

However, software financing options have become available within certain situations, especially if that financial institute has a close relation to the software provider. SFC, for example, offers finance-related strategies that include their product management and design software.

I know that software is not that useful without a physical tool or machine, especially for Metal fabrication and manufacturing industry. That’s why, in this case, the real value of a manufacturing productive asset lies in software and control, apart from the people who work there.

Now more than ever before, industrial financing requires working with different companies’ making, upgrading, repairing, and servicing. Also, Metal fabrication industry should think about the advancement in technology and realize that they are only losing their business if they cannot cope up with others who have the fascinating tech, which a few years ago, no one could have thought about. So it’s their time to invest in their business to keep it going at pace with the world. Otherwise, it’ll lag behind and shoot from its orbit like a falling star.